We wanted to highlight four core capabilities that help you gain greater confidence, clarity, and accuracy across project work.

Here's how it works:

Document Review

Automatically review project documents such as assessments, contracts, RFP responses, and CIMs for accuracy and completeness, catching inconsistent narratives, missing sections, and compliance gaps before submission.

Financial Model Validation

Check financial models such as pro formas, development budgets, cash flow projections, and feasibility studies against your assumptions and project data, identifying formula errors, unrealistic projections, and missing line items before they reach investors or lenders.

Drawing Validation (coming in the new year)

Validate architectural drawings such as site plans, floor plans, elevations, and construction details for alignment and omissions, spotting conflicts between architectural, structural, and MEP drawing sets and missing elements before construction begins.

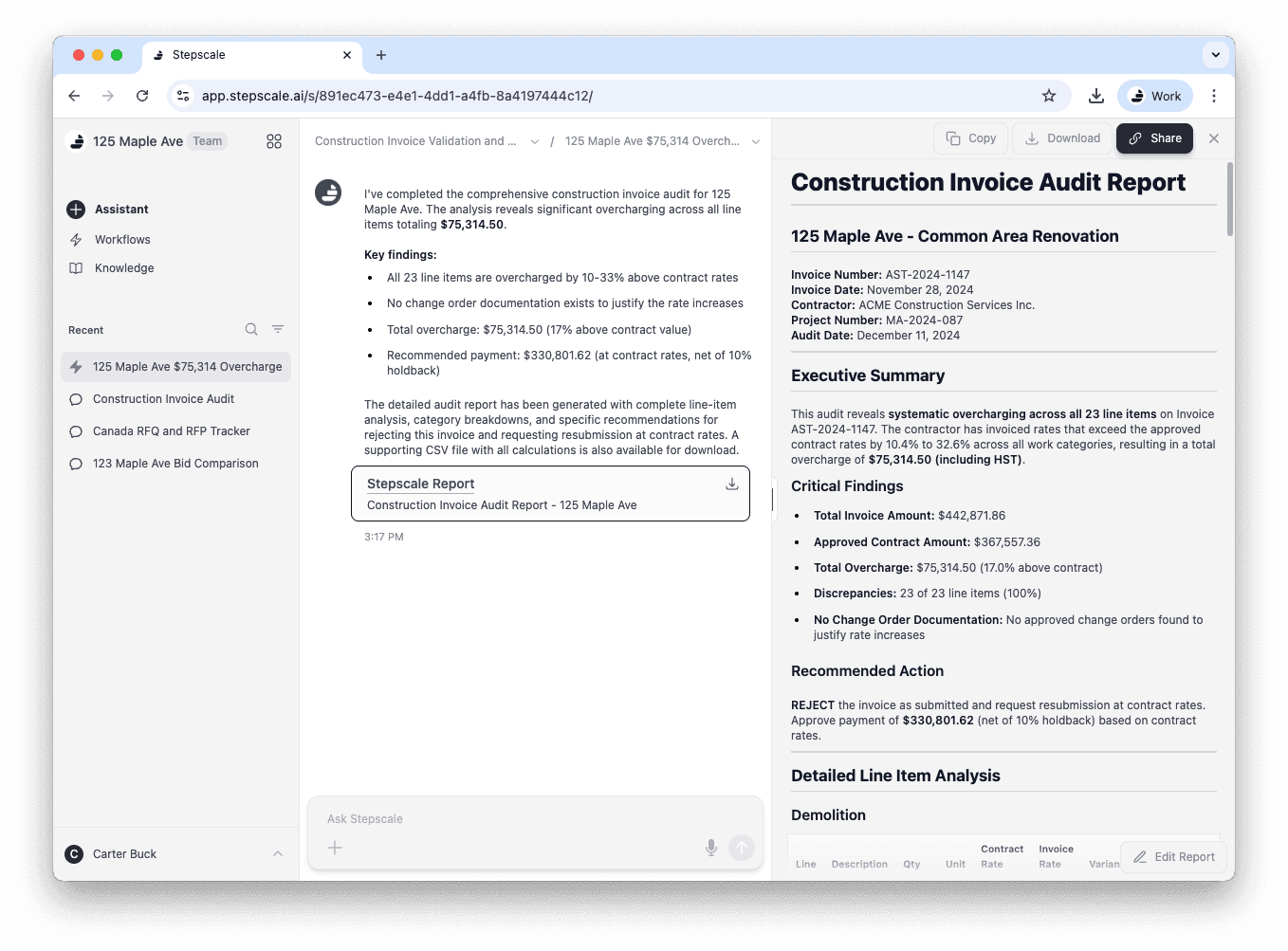

Invoice Auditing

Audit invoices such as contractor progress claims, consultant fees, material invoices, and change orders for accuracy and contract compliance, flagging duplicate charges, rate discrepancies, and billing errors before payment processing.

What customers are saying:

"Stepscale caught a formula error in our pro forma that would have cost us $500K."

— Development Manager

"We found drawing conflicts before construction started that prevented $200K in rework."

— Project Lead

"Stepscale caught $150K in invoice errors before we processed payment."

— Asset Manager

Whether you're an expert Stepscale user or just discovering it, everything you need is one click away

If you're not using Stepscale yet, let's talk>